Paying a claim is an essential part of the insurance value proposition; it’s a critical component of the promise that insurers make to their policyholders – to cover them in the case of a loss. The insurance claims experience, then, becomes a pivotal moment for insurers and policyholders alike.

It’s in that often frustrating and distraught moment of filing a claim that insurers prove to their customers how much (or how little) they care for the customers they protect, and how deserving they are of their customers’ business. that directly impacts customer loyalty, retention, and the brand of the company

Why does the claims experience have such a bad reputation for being outdated and painful? Based on our industry experience and work with dozens of insurer clients, we’ve compiled a quick overview of the why and how of improving the insurance claims experience.

Why Improve the Claims Experience?

What many insurance customers experience when they file a claim is frustration. Complaint data from the National Association of Insurance Commissioners revealed that the overwhelming majority of complaints — 68% — involved claims.

In fact, in 2021, customer satisfaction fell to a five-year low, according to the “J.D. Power 2022 U.S. Property Claims Satisfaction Study.” The causes of the low scores were a complex claims process, communication challenges, and slow cycle times. With an average of 17.8 days, property claim repairs took 2.9 days longer in 2021 than in 2020.

Customers who are dissatisfied with their claims experience are more likely to switch carriers. Considering that it takes years for an insurer to recoup the cost of acquiring a customer, improving the claims experience becomes imperative for the bottom line.

Main Challenges to a Better Claims Experience

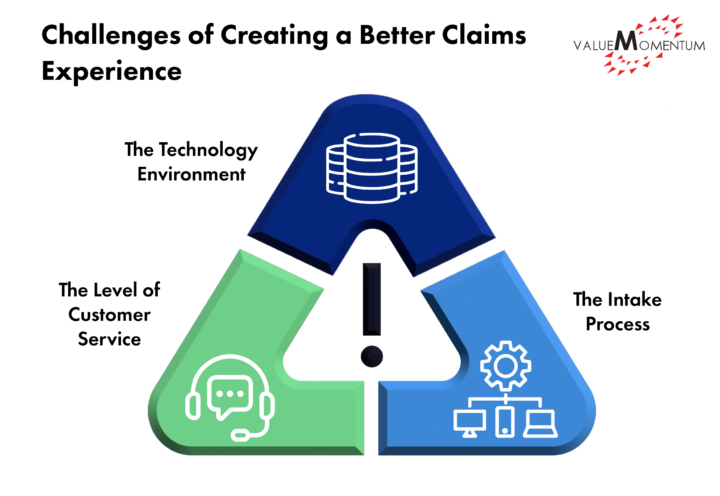

Improving the insurance claims experience requires insurers to evaluate three main areas of their organization: the technology environment, the intake process, and the level of service. These three areas constitute the main challenges of creating a better claims experience.

The Technology Environment

A technology environment with outdated, disparate systems is by far the biggest challenge for any insurer aspiring to get up to digital speed and provide better customer experiences. With regards to claims—a process that requires data to be pulled from multiple internal systems, as well as received from and sent to various external vendors—outdated and siloed technologies make it significantly more difficult to achieve speed and quality in the claims experience.

The Intake Process

Often, the first notice of loss (FNOL) and other initial steps for filing a claim turn into a friction-filled experience for customers. In a digital world where consumers expect the ability to access their policies from any device, anywhere they want, they expect to have access through their channel of choice.

As the J.D. Power report noted, the customers who used digital tools to activate their claims at FNOL shortened the process by nine days, on average. Their satisfaction rates were 33 points higher than those who did not use digital tools. On the other hand, customer satisfaction rates plummeted by 47 points when the digital process didn’t work as promised, and they still had to wait on an in-person inspection.

The Level of Customer Service

Although consumers are embracing digital technologies and generally prefer automation tools to expedite processes, many still like to speak to a person about their claim concerns. Being there for policyholders at that critical time and being responsive to what they need goes a long way in strengthening customer loyalty and retention.

3 Steps to improve the claims experience

Insurers need to adapt their processes and overall business model, as well as implement omni-channel engagement to improve the handling of claims. As the causes of failure are three-fold, it takes a three-pronged approach to transform the claims experience into one that meets customers’ expectations today.

- Upgrade your data management

Insurance involves vast amounts of data, which can be leveraged to speed up a process, customize a service, or offer better products. To leverage all that data, insurers need the right architecture (such as APIs for integrating with third-party data sources), as well as the right tools, and a skilled IT team.Insurers can streamline their processes and offer more user-friendly experiences by simply improving their data management practices. Knowing what kind of data is needed and where that data comes from will help insurers lay the right technology foundation for better customer experiences.

- Streamline the claims process

Recognizing and removing any unnecessary steps during intake will streamline the entire claims process. A good area for improvement is the FNOL process.Customers want convenience, ease of use, and transparency. That’s why insurers should provide an easy way for claimants to submit a claim, offer different channels so that claimants can submit documents through their channel of preference, and keep claimants engaged by actively updating them on the status of their claim.

- Provide consistent customer service

Customers want friendly, reliable, consistent service every time, not just during the sales stage of the relationship. As policyholders are usually distraught when they experience a loss, the claims experience is an opportunity for carriers to strengthen their relationship with the customer and emphasize the values of the company.Setting a customer service standard (i.e., guidebook) and holding conflict de-escalation training for customer service representatives may help insurers achieve a higher level of customer service during the claims process. Alleviating the anxiety of uncertainty customers experience when waiting on a claim goes a long way for customer loyalty.

Better claims experience strengthens customer loyalty

Given the fact that it takes years for an insurance company to recoup the cost of acquiring a customer, retention is not only desirable but essential. While every customer touchpoint is important, the nature of the insurance claims transaction makes it a golden opportunity for insurers to strengthen relationships and build loyalty with their customer base.

The possibility of incurring damage to a home or car is the reason people become insurance customers. When they find the claims experience a grueling ordeal, though, they may reconsider their choice of insurer. That is why improving the claims experiences is essential for insurers who aim to retain their customers and reap the reward the lifetime value of the customer (LTV).

Are you ready to deliver the delightful experiences that win new customers and retain your current ones? Find out how ValueMomentum’s Digital & Cloud Services can help your firm improve the insurance claims process.